Gram Virtual CFO.

From the horizon to the bottom line.

ABOUT US

We keep our eyes on your horizon,

while never taking our focus off the bottom line.

The journey of a startup or scale-up is rarely steady or predictable. With every milestone, comes new opportunities and obstacles. The support of a CFO can be invaluable to the survival of your business, and a catalyst for sustainable future growth.

SERVICES

We specialise in managing

the finance operations

We add value to clients that do not have an in-house CFO or finance team, by tailoring a high-quality service to fit the needs of the business.

Find out more about the CFO services we can offer you.

HOW WE WORK

We understand that you’re juggling many competing demands in managing your company.

Our goal is to relieve the strain and build your finance capability.

Interested?

Speak to one of our advisors to discuss your specific needs and how we can meet your objectives.

HOW WE CAN HELP

Benefits of a Virtual CFO

-

A virtual CFO helps you analyse key business drivers

You think your company should be growing faster to toward break-even and generating profits, but do you have the data to analyse this?

A Gram virtual CFO is an experienced financial analyst. We dive into your business and provide insights that enable you to leverage the opportunity available to you. -

A virtual CFO helps you analyse key business drivers

You think your company should be growing faster to toward break-even and generating profits, but do you have the data to analyse this?

A Gram virtual CFO is an experienced financial analyst. We dive into your business and provide insights that enable you to leverage the opportunity available to you. -

A virtual CFO helps you analyse key business drivers

You think your company should be growing faster to toward break-even and generating profits, but do you have the data to analyse this?

A Gram virtual CFO is an experienced financial analyst. We dive into your business and provide insights that enable you to leverage the opportunity available to you.

OUR BUSINESS

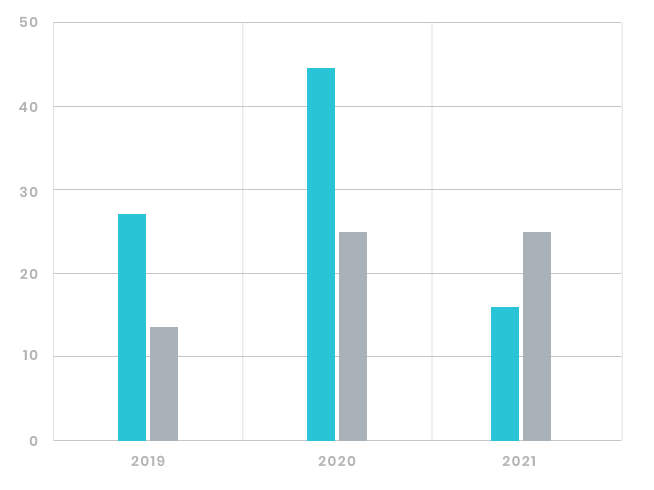

Suspendisse dapibus orci in nibh aliquam

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s

OUR BUSINESS

Suspendisse dapibus orci in nibh aliquam

- Donec porta leo ac ultricies lacinia.

- Sed fermentum velit vel elementum viverra.

- Integer elementum nibh a ante feugiat hendrerit.

- Sed dapibus turpis vel tortor pretium finibus

Gram Virtual CFO.

From the horizon to the bottom line.

Our Clients

Our Clients

What they say

“Gram has been an integral part of our team for a number of years now. With Gram, we have access to a highly skilled team with the right level of experience to help us achieve our strategic objectives. The Gram team, led by Louise, handles challenges and the fast-paced environment of a start-up with ease. Our company has recently been through a trade sale and Louise was a key member of the transaction team. Having a CFO with the right breadth of experience enabled us to complete the transaction quickly and efficiently.”

Lee O'Mahony, Chief Commercial Officer, HROnboard

What they say

“Margarita and the Gram team are awesome. They understand the challenges of the start-up world, and provide the perfect balance of move fast and rigour. They are super efficient and never complain. I always feel like I am their only client. I don't hesitate in recommending the team at Gram, having worked with Margarita across three start-ups, it’s a no brainer!”

Adam Theobald, Co-founder and CEO, Ordermentum

what they say

“"We recently listed on the ASX and the Gram team led by Margarita, were an integral part of this process. Gram delivered to a high standard all financial requirements for the prospectus, continued the day to day finance operations, as well as build the finance capability to support us now we are a public company”

Nick Armstrong, Founder and CEO, Identitii

Prev

Next

When is the right time to hire a CFO? + -

It is never too early to engage a CFO due to the value they can add to your business. However, in our experience companies often seek a CFO when they start to experience pain points or stress around the following areas:

- You need to raise funds.

- You don’t have the accurate information you need to make sound decisions for your business.

- Managing your finances is eating into the time you should be spending on core business activities.

- Your business is growing and you feel out of your comfort zone or feel like you could benefit from an independent sounding board.

What are the benefits of a Virtual CFO? + -

Businesses that don’t currently employ a CFO can benefit hugely from bringing in a Virtual CFO. One of the main reasons that startups fail is because they run out of money. A Virtual CFO will help you understand and manage the lifeblood of your business - cash flow - safeguarding the future.

In addition, you can expect more robust financial reporting and greater visibility across your finances as a whole, helping you make more informed decisions and primed to exploit the right opportunities. Hiring a Virtual CFO allows you to take your business to the next level, at a fraction of the cost of employing a full-time employee.

What does a Virtual CFO do? + -

At Gram we offer a broad range of support and will tailor our service to suit the needs of your business.

A Virtual CFO can assist with:

- Capital raising

- Corporate governance

- Cash flow reporting, modelling, and management

- Business planning

- Identification and monitoring of key business metrics

- Monthly management reporting

- Financial management and analysis such as preparation of budgets and operational forecasts

- Set up of accounting systems and processes

- Monthly accounting and month end procedures

- Payroll & HR Admin

- Accounts payable and sales invoicing

How does a Virtual CFO actually work in practice? + -

It varies from company to company, but at Gram, we work hard to become a member of your team. We prefer a proactive approach and aim to build your capability, from general finance hygiene and governance, to a point where you are comfortable and confident in your numbers.

We agree a range of services which we provide for a fixed monthly fee. As a growing business we know your needs will change as you scale, so these services may change from month to month. What will not change is our accessible service. We provide daily support through phone calls and emails whenever you have a question or a concern, as well as joining monthly management and Board meetings with you and/or your team to make sure everyone is on the same financial page.

Shared effort. The Gram difference.

We work hard as part of your team as we know that running a successful startup or scale-up business means it’s all hands on deck. We bring an enhanced skill set and broad experience to build and embed the financial discipline required to support the growth of your business.